“The major technology corporations operating in Israel continue to recruit employees. We are feeling the increasing demand from the giant companies, especially in the areas of demand — Tel Aviv, the Herzliya area and Matam Park in Haifa. In fact, demand exceeds supply. There is very strong demand for the establishment of development centers, and we see and believe that this trend from the major high-tech companies will be maintained and continue – both in terms of occupancy levels, high rent levels and in terms of the long duration of contracts.”

And thanks to the tech giants: The high-tech sector, in Israel and around the world, has been the focus of tremendous attention in the last two years, for both positive and negative reasons. If during the second half of 2020 and during 2021 it made headlines due to the brilliance of the huge recruitments that turned many companies into unicorns and the pampering conditions for employees, then in recent months, under the auspices of rising interest rates and market turmoil, the sector has been making headlines due to layoffs and downsizing. But at Gav-Yam — the income-generating real estate company that is probably the most prominent landlord in the sector in Israel — business continues as usual, and even more so.

In a conversation with Calcalist on the occasion of the publication of the financial reports for the second quarter and the first half of 2022, Gav-Yam CEO Avi Yakubovich said today that “the largest technology corporations operating in Israel continue to recruit employees. We are feeling the increasing demand from the giant companies, especially in the areas of demand – Tel Aviv, the Herzliya area and Matam Park in Haifa. In fact, the demand exceeds the supply. There is very strong demand for the establishment of development centers, and we see and believe that this trend from the large high-tech companies will be maintained and continue – both in terms of the occupancy level, the high rent level and in terms of the long duration of the contracts.”

The words of the CEO of Gav-Yam are expressed even more strongly in the renewals of the contracts. During the second quarter, Gav-Yam signed 31 new contracts for the lease of 23,000 square meters of surface area. The average real increase rate of these new contracts was 10.9%. This is a higher rate than in the first quarter of the year, as the average increase rate in the first half of the year was 7.9%. Almost half of these new contracts (44%) are contracts in which tenants changed, and these presented a real increase of 19% – the highest in Gav-Yam’s history. A similar rate of new contracts came from the exercise of options by existing tenants, and accordingly the real increase in rent was a much lower rate – 3.7%. The increase in rent as part of contract renewals was 7.2%.

Business as usual, and beyond that: If these figures seem to be in complete contrast to the general sentiment in the market, then the reason lies in the identity of the tenants of Gev-Yam. The company, whose property occupancy rate is 98%, currently has 22 high-tech, industrial and logistics parks, where it leases more than a million square meters to the largest and most powerful companies (Tier 1) — Apple, Google, Amazon, Microsoft, General Motors, Dell, Nvidia, ZIM and Oracle. This is a partial list, and Facebook is missing from it. It’s not that Gev-Yam wouldn’t be happy to lease space to Meta (Facebook’s current name), but there is a symbolic dimension to this fact. Facebook’s stock, which has fallen 53% since the beginning of the year, is the hardest hit of the tech giants included in the group known as FAANG (Facebook, Apple, Amazon, Netflix and Google). Apple, which leases space from Gev-Yam in Herzliya, has even signed a lease for additional space totaling 60,000 square meters. Gav-Yam never published Apple’s name, but reported that it had leased additional space to a large international company, but the identity of the lessor, which was not confirmed by the company, was leaked to several media outlets.

In line with the growing demand, Gav-Yam is currently promoting 19 more projects. According to Yakubovitz, “Of all the projects we are carrying out today, 57% of the spaces included in them have already been marketed and agreements have been signed with tenants, while in some of the projects we have not yet broken ground.” By this, Yakubovitz means that the construction of the projects is still in the foundation stage and the buildings cannot yet be seen above ground. In other words, the projects are in a very early construction phase. According to the CEO, “These projects will generate revenues of NIS 550 million and an addition of NIS 330 million to the FFO attributable to shareholders. The contracts already signed alone will add 107 million shekels to this figure.”

Gev-Yam’s record results translate into dividends

In addition, Gev-Yam is currently promoting plans for historic lands it owns in Acre, Rehovot, Jerusalem, Herzliya and Tel Aviv. “Currently, there are 190 thousand square meters built on these lands. If the plans are approved, it will be possible to build 690 thousand square meters of employment on these lands, “67,000 square meters of industry and commerce, and 2,300 apartments. This is a very significant value addition,” said Yakubovich.

The good side of inflation: As mentioned, the market turmoil is occurring against the backdrop of rising interest rates as part of the monetary tightening that central banks around the world are carrying out to try and put the stubborn inflation genie back in the bottle, but this situation is not necessarily bad for Gev-Yam. Its contracts are linked to the consumer price index (the increase in which is actually inflation), and along with the renewals of contracts at higher prices, this contributed to Gev-Yam’s financial results.

In the second quarter of the year, Gev-Yam reported a 7% increase in income from property rentals and management fees, which amounted to NIS 160 million. This was mainly due to the increase in the consumer price index and a real increase in rental fees. This led to a 5% increase in NOI (profit from property rentals, net of depreciation) to a level of NIS 137 million. NOI from identical assets, i.e. those that were fully operational during both periods, was NIS 134 million — an increase of 6%. FFO attributable to shareholders (net profit excluding gains and losses from the sale of assets, revaluations, depreciation and non-cash expenses) jumped 34% in the second quarter of the year and stood at NIS 82 million. This was as a result of the increase in income and decrease in net interest expenses, which occurred thanks to the repayment of high-interest bonds, and the raising of bonds in the amount of NIS 1.2 billion at a weighted average interest rate of 0%.

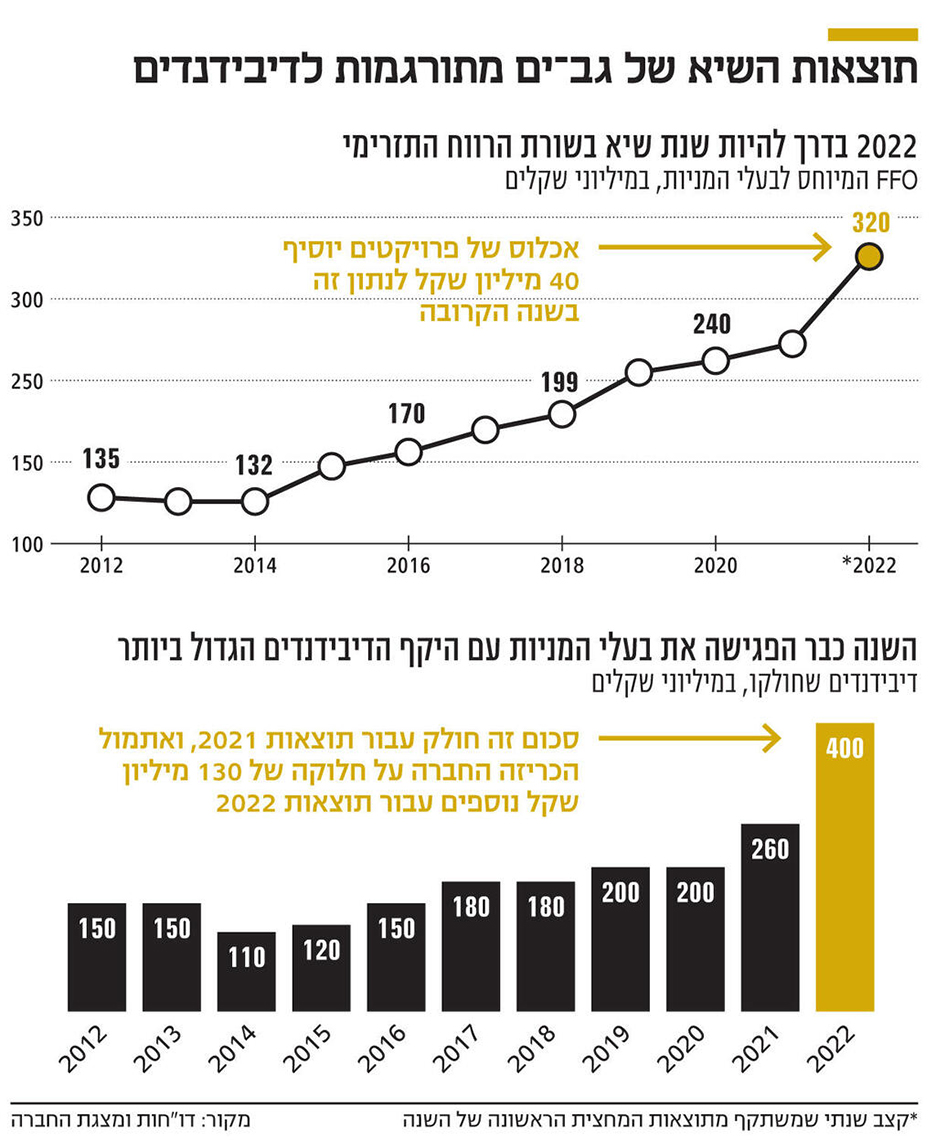

FFO attributable to shareholders in the first half of the year was NIS 149 million, an increase of 22% compared to the corresponding period and a figure that reflects an annual rate of NIS 320 million. This amount is the highest FFO attributable to shareholders in the company’s history. For comparison, the strongest annual figure recorded in this sector was in 2021, when FFO attributable to shareholders stood at NIS 253 million. “Thanks to the occupancy of four additional projects over the next 12 months, FFO attributable to shareholders is expected to grow by NIS 40 million to NIS 360 million on an annualized basis,” added Yakubovitz.

The increase in the index, the reduction in discount rates and the increase in land values led to Gev-Yam recording revenues of NIS 684 million in the second quarter of the year from an increase in the fair value of investment real estate — a jump of 82% compared to the same period — which contributed to the fact that net profit attributable to shareholders almost doubled, from NIS 263 million in the second quarter of 2021 to NIS 508 million in the current quarter.

Good news for Properties and Building: Against the backdrop of these strong results, Gev-Yam announced a dividend of NIS 130 million. This dividend joins the dividend of NIS 400 million distributed at the beginning of the year for 2021 results – which already makes 2022 the year in which Gev-Yam distributed the largest volume of dividends in its history. This is beneficial for the controlling shareholder Properties and Building (86.7%), which reached its holding The current one after purchasing 37.2% of the shares of Gav-Yam from Aharon Frankel for NIS 3 billion, in a huge deal that it was also forced to finance with a bank loan of NIS 950 million, taken after Assets and Building failed to sell the HSBC building in New York for $ 855 million – a sale that was supposed to be a central pillar in financing the deal with Frankel.

Meanwhile, Gav-Yam announced today that Eldad Fresher, former CEO of Bank Mizrahi Tefahot, will cease to serve as chairman of the company, and will be replaced by Mikey Zalkind, who, together with his brother Danny, holds control of Elco, which is one of the two largest shareholders in DSKSH (29.9%) – the controlling shareholder of Assets and Building and Gav-Yam in the chain.

A TASE study found that 63 publicly traded companies consistently distributed dividends over at least ten years. Their shares in the last decade yielded average returns of 350% compared to 56% generated on the TA-125 index. 75% of the companies that maintained consistency recorded triple-digit returns.

The company, whose products are sold mainly to the defense industry, leased the new office spaces in Jerusalem at an annual cost of around ILS 7 million; the Givat Ram Campus project is a joint project of Gav-Yam, The Hebrew University and the Jerusalem Development Authority; tenants are expected to occupy the project’s first stage in late 2024